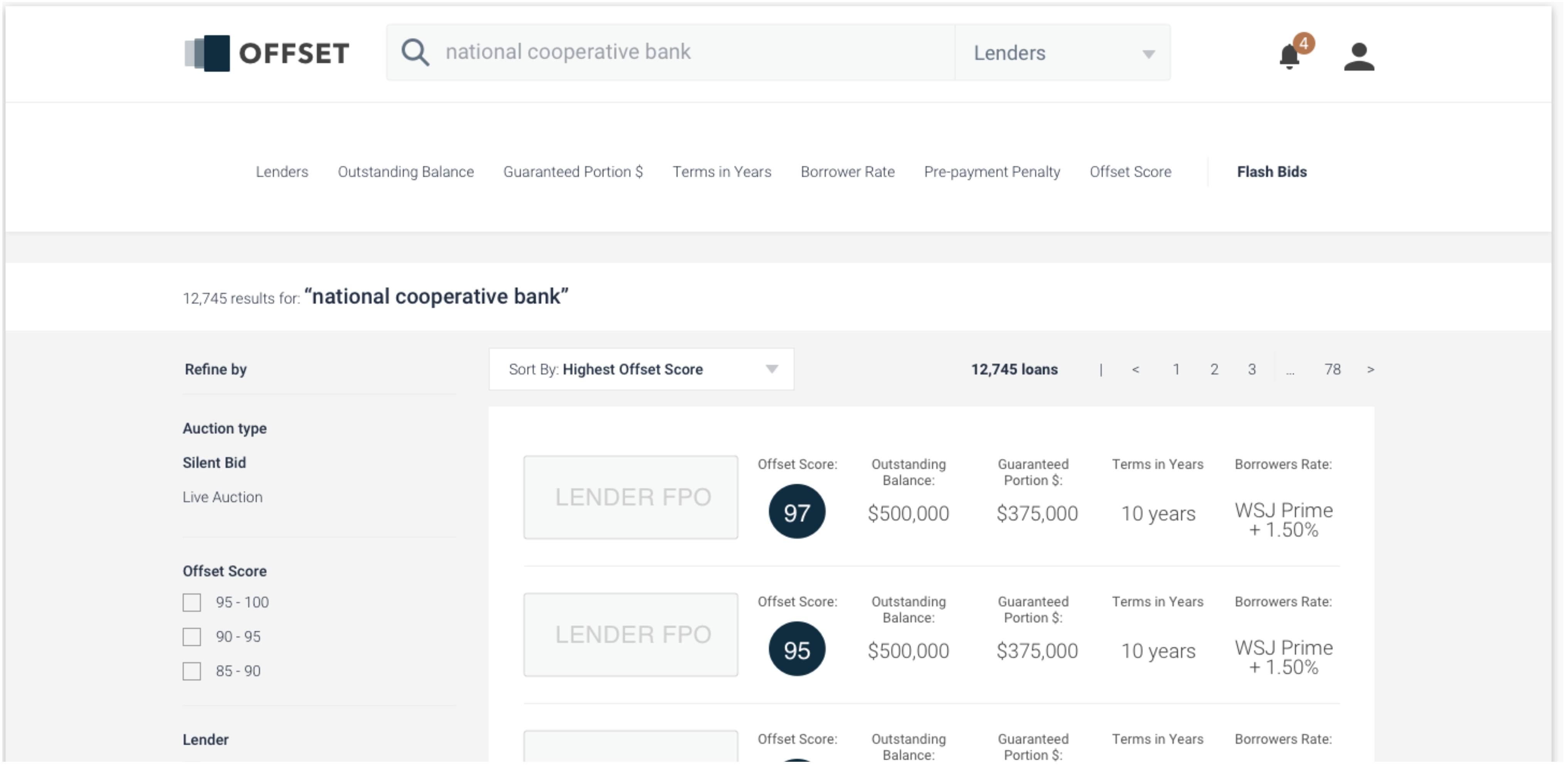

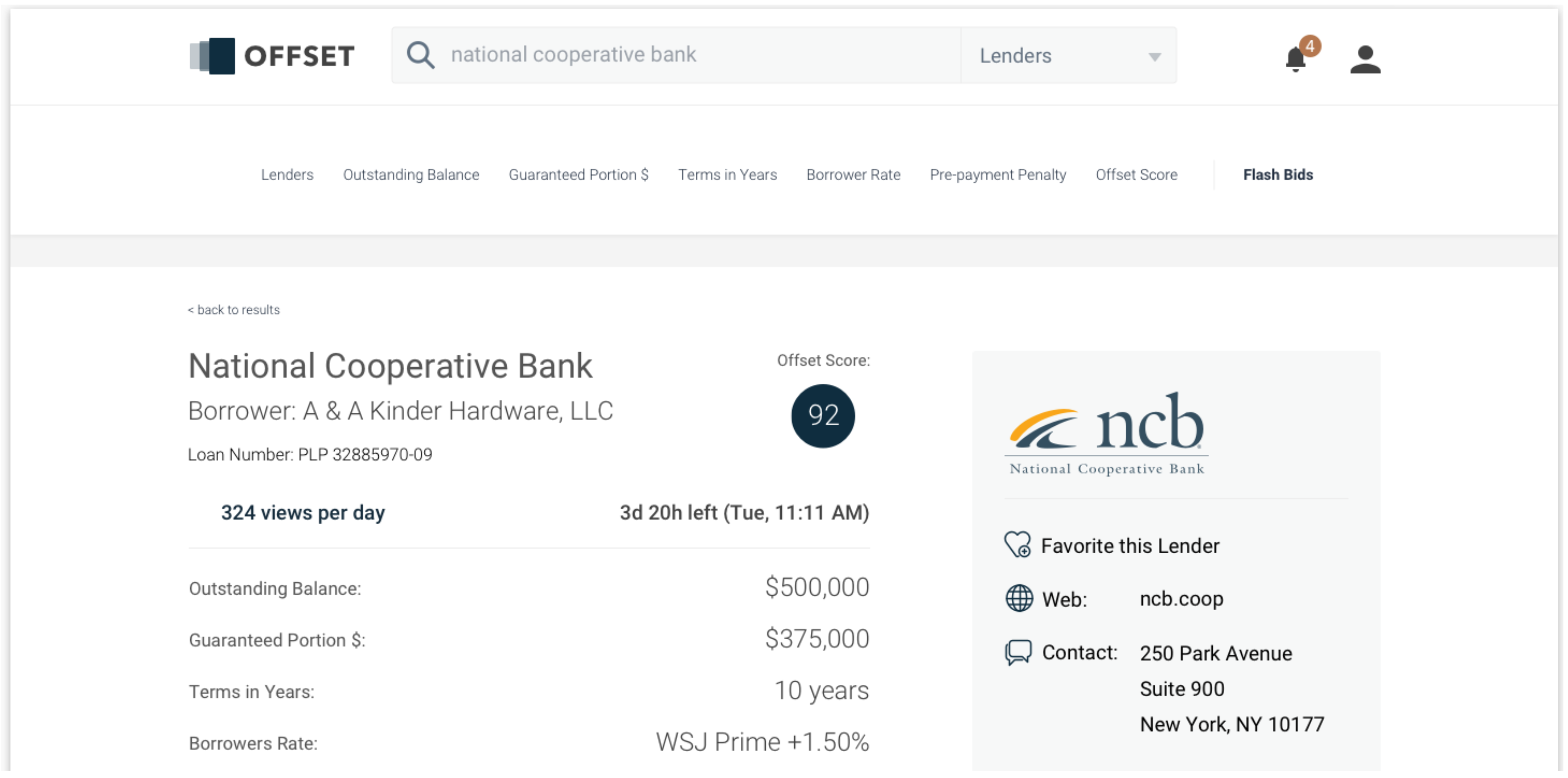

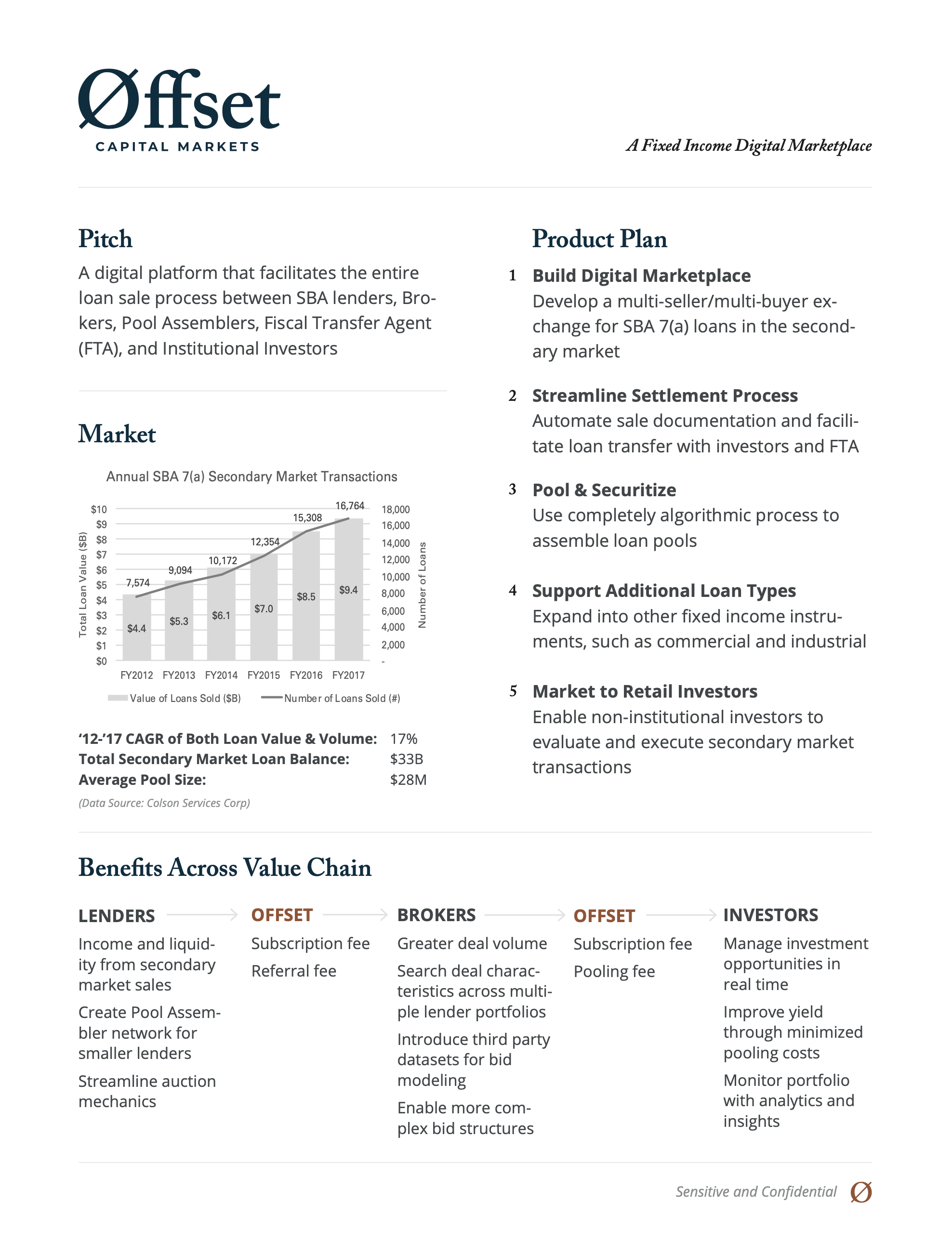

build an entirely digital, two-sided marketplace for secondary transactions involving SBA-backed loans. This will allow lenders to publish their secondary market investment opportunities to many multiples of the current number of investors, while also minimizing small business loan credit exposure.

Pitch One-Pager

understanding the lifecycle of an SBA loan

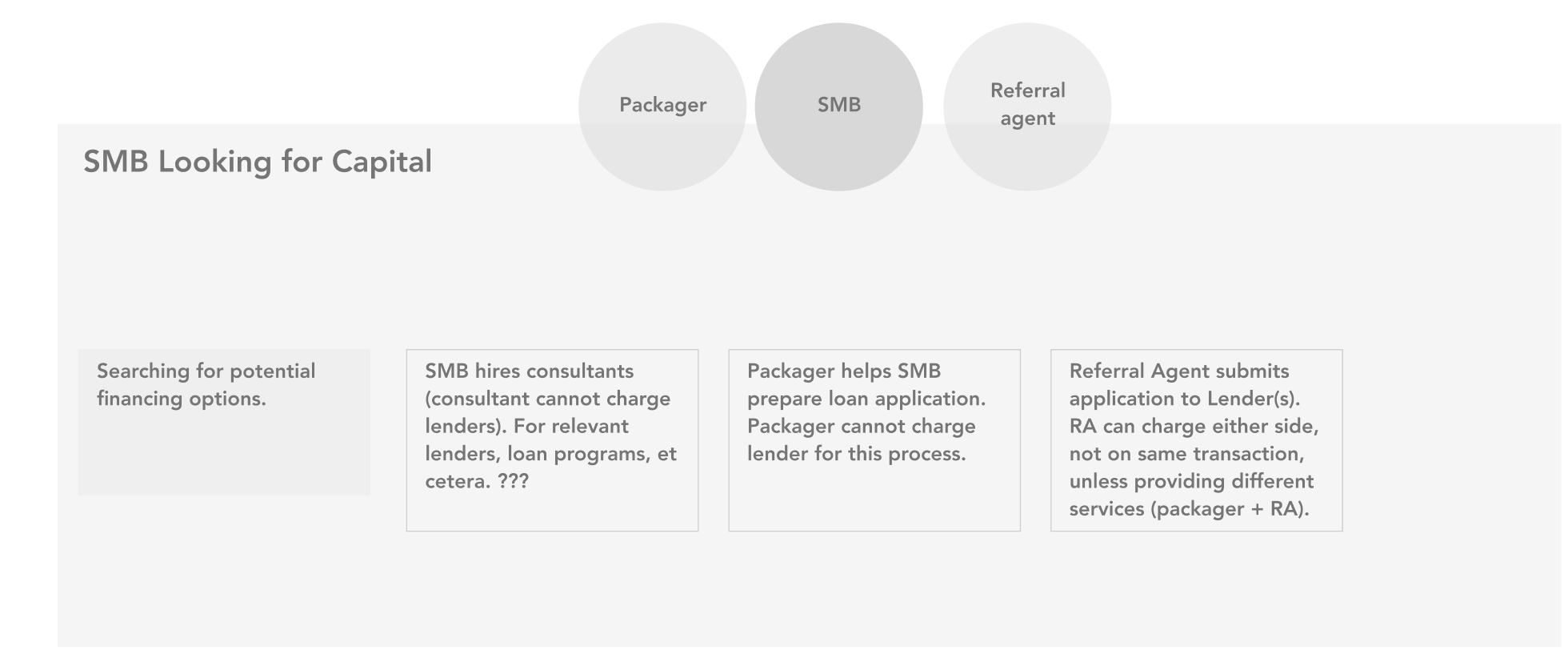

Small Business Looking for Capital

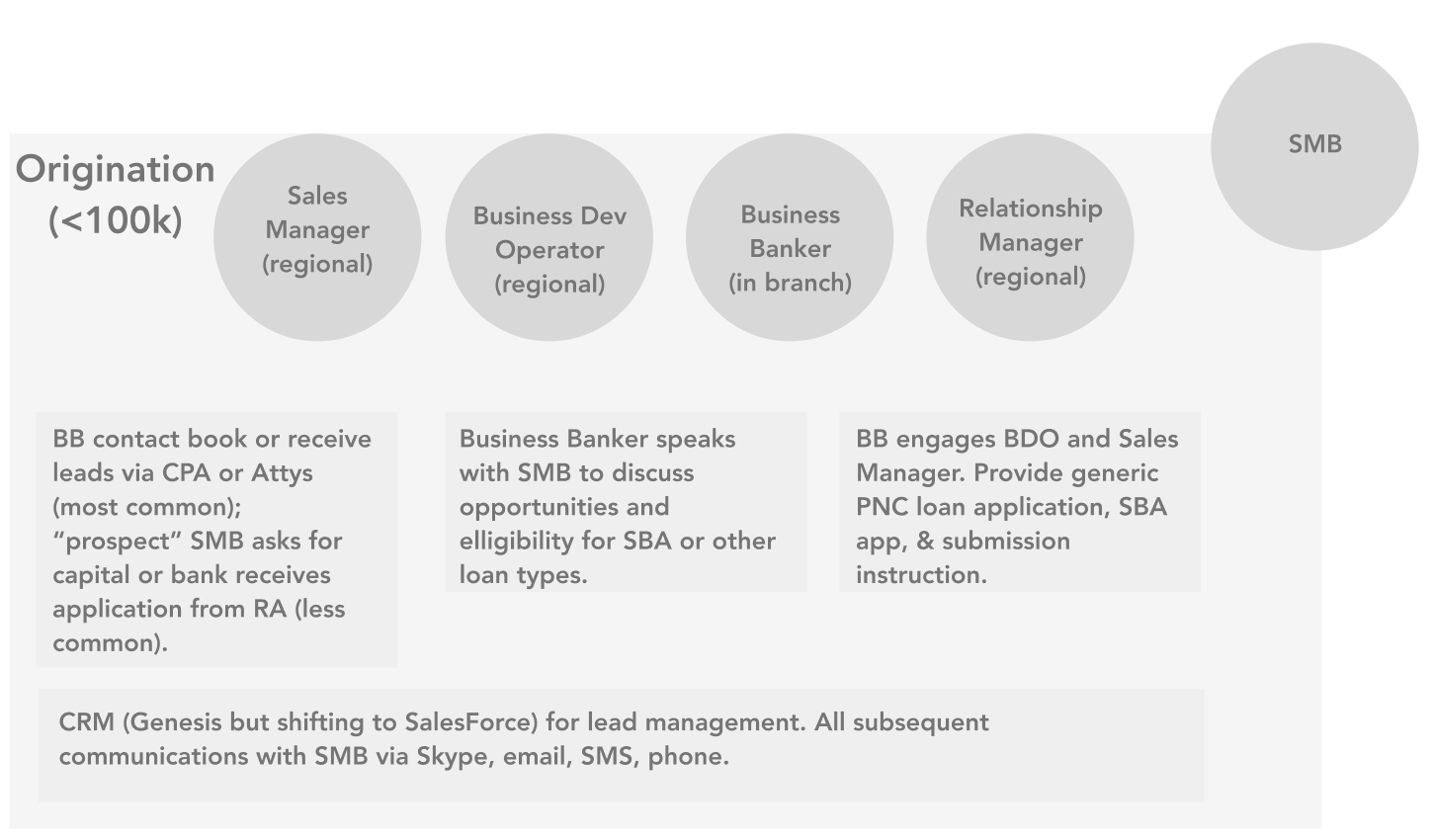

Origination

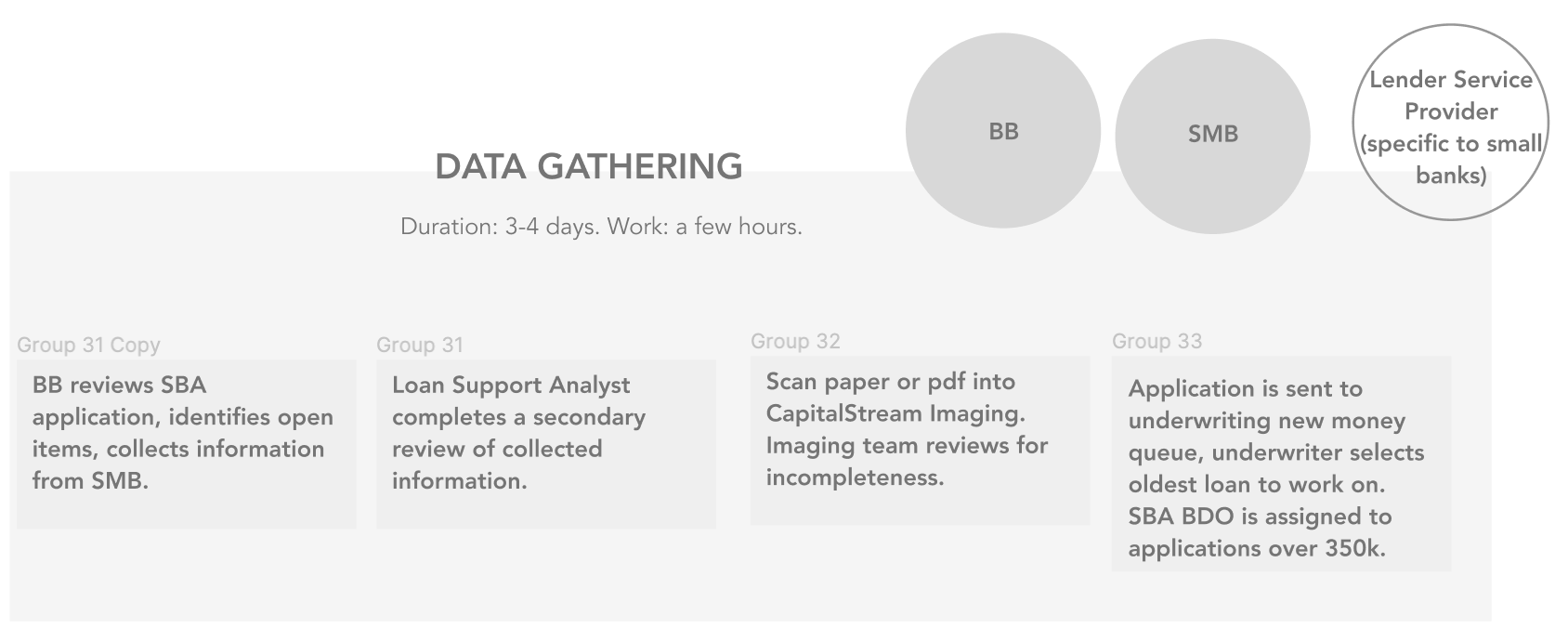

Data Gathering

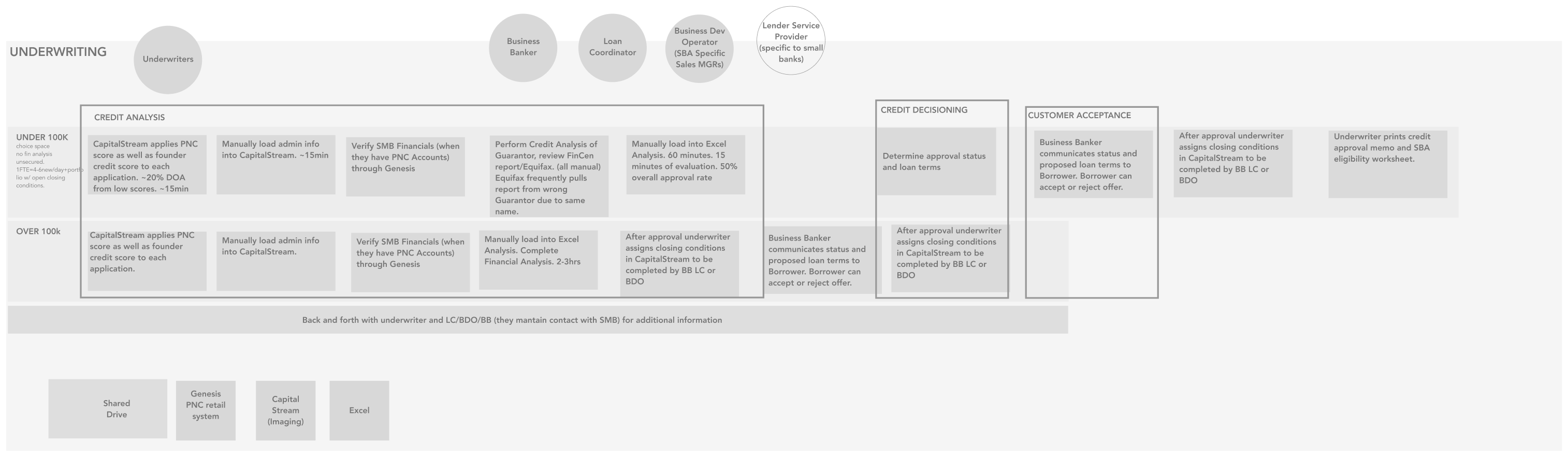

Underwriting

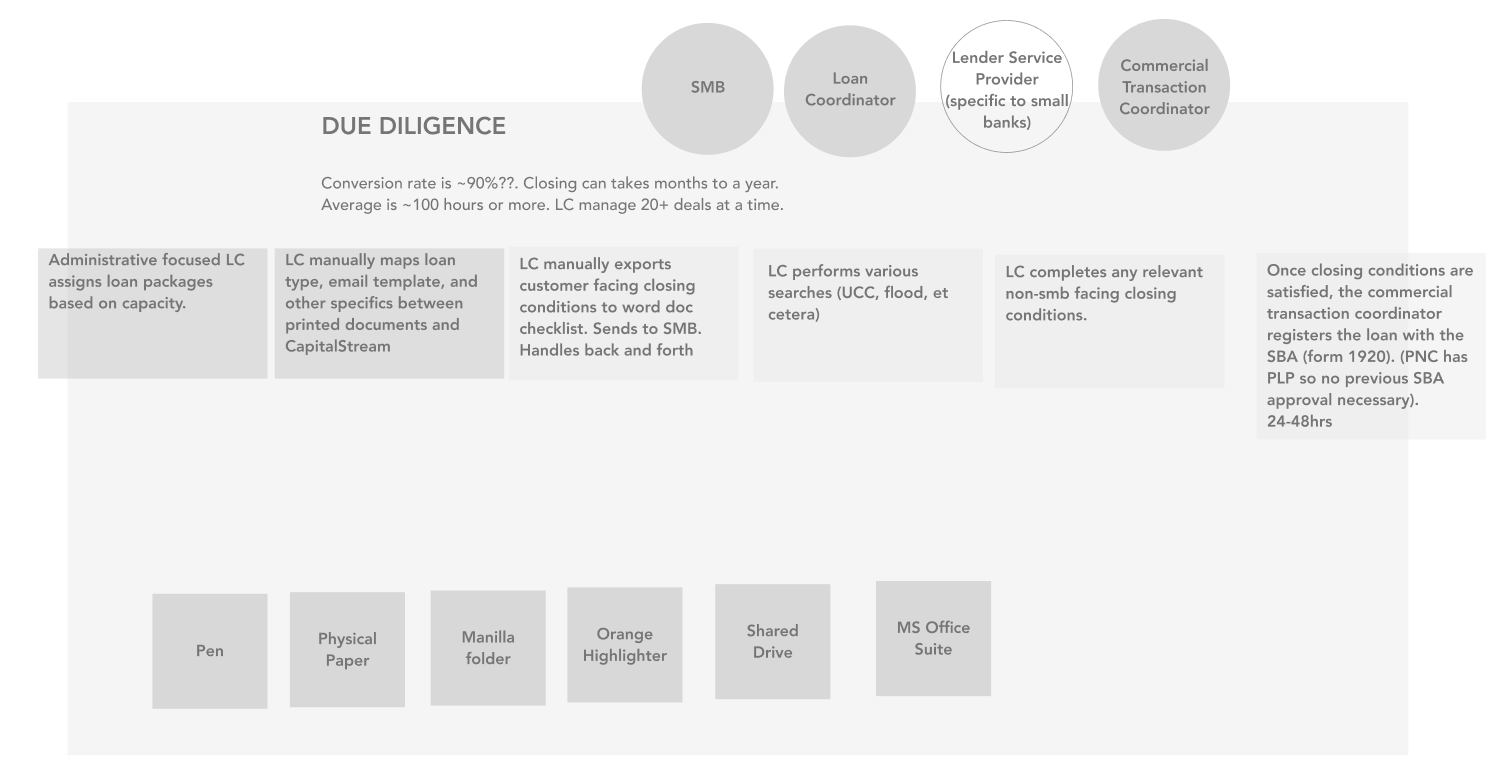

Due diligence

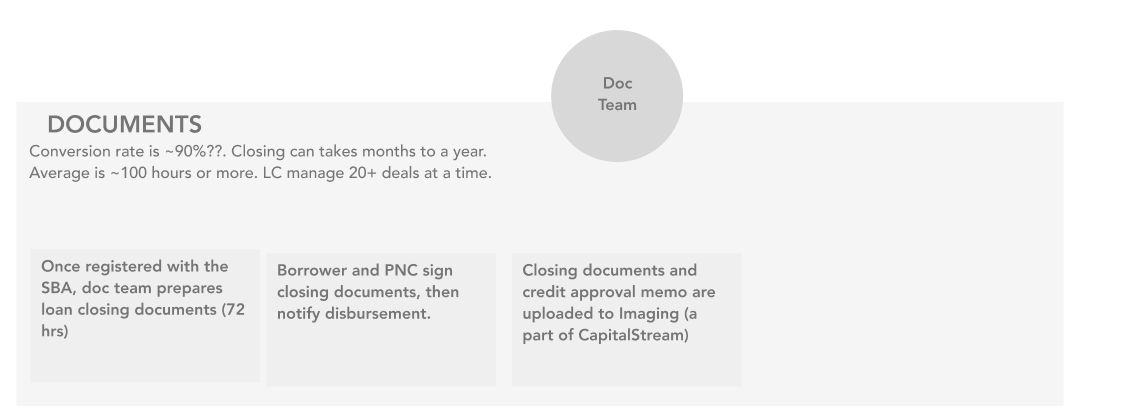

Documents Gathering

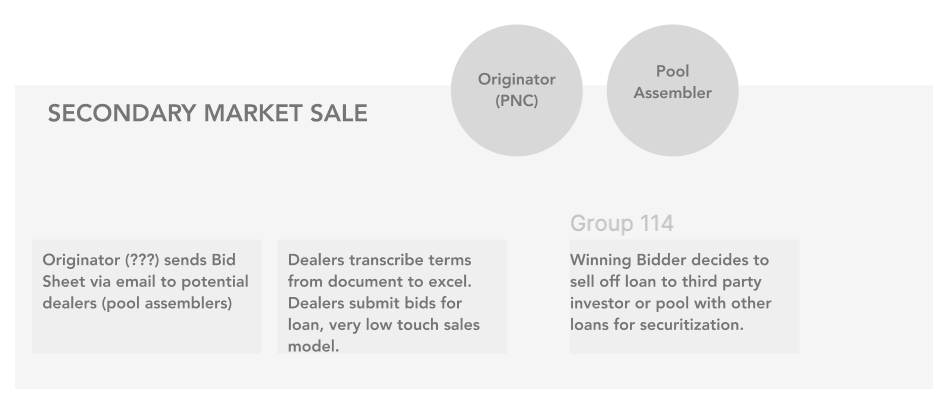

Secondary Market Sale

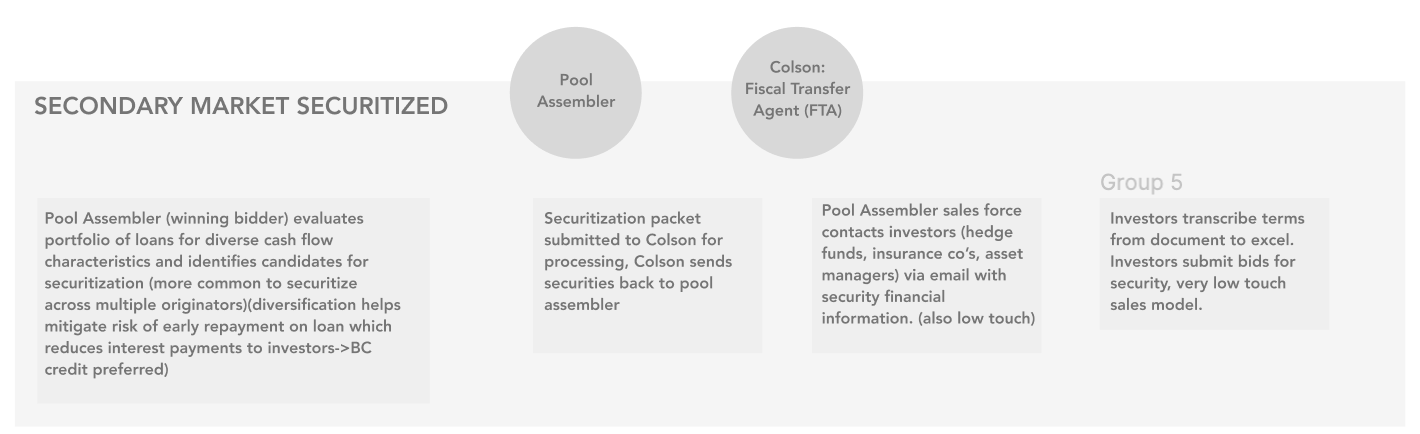

Secondary Market Securitized

The secondary market was comprised of Pool Assemblers that spliced individual loans into traunched securities. After visiting some of their headquarters, we realized that this was a completely manual process, and that loans were never sold individually, just bucketed and tossed into Bloomberg.

Entire Process from Origination to Secondary Market Sale

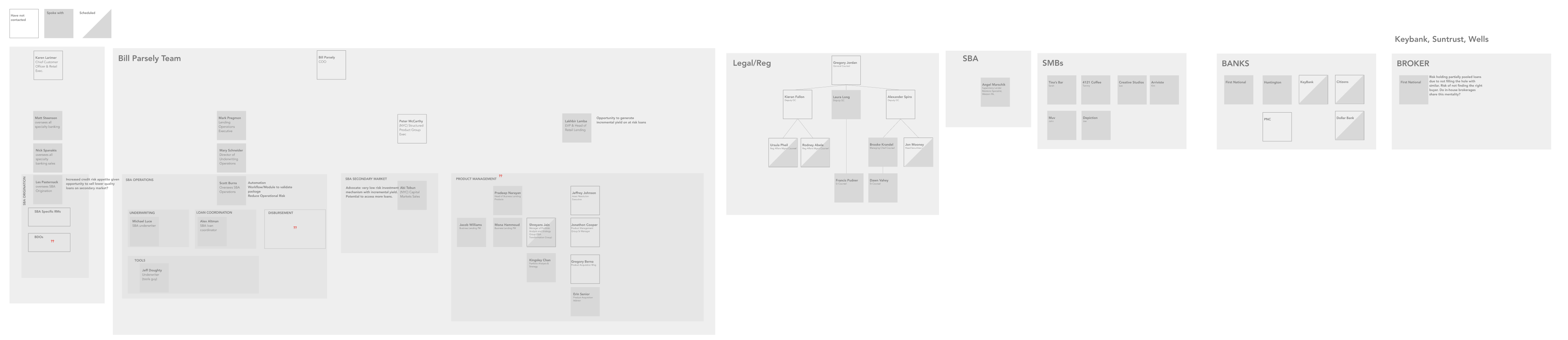

Gaining buy-in inside and out of the Organization

To push this through the organization, it was important to get the right people on-board. This in itself was a project. I managed this process out of a makeshift Figma model of the org chart and before pitching to the c-suite, we had advocates across the company from the Deputy GC to the EVP of Retail Lending, to the Chief Customer Officer.

We also vetted the concept with half a dozen local small businesses as well as 5 banks with local headquarters.

Screenshots

The final pitch to the C-Suite was approved (.5MM) including pixel perfect screenshots before I spun off the project.